Borrowing money interest rate calculator

Calculating the total interest paid on your loan will show you the true cost of borrowing money. Determine whether saving money vs borrowing is better.

Simple Loan Calculator

When Fed rate hikes make borrowing money more expensive the cost of doing business rises for public and.

. An important aspect of business borrowing is the form of security required - property or business assets. The formula for calculating simple interest is. For example if a borrower has Rs.

Even a small difference in the interest you are paid on your savings can add up over time. 20000 as overdraft then the interest rate shall be charged on the withdrawn amount that. The amount of interest you pay is calculated based on your annual interest rate balance and how much you pay each month.

From our example above where you have 13000 as your lease cost 15000 of depreciation minus the 2000 down payment you made a money factor of 0016 which translates to an interest rate of 4 percent will mean you pay roughly 943 in interest over a 36-month. To maintain the. Use our mortgage interest calculator to find out how much extra youd pay if your mortgage rate increased by between 025 and 3.

This calculator can also show you how deposits at the start of each month compared to the end of the month can impact your savings balance. When you borrow money from a lender you are required to make repayments typically monthly to repay the money borrowedThis repayment includes the principal taxes insurances and the interestThe amount of interest that accumulates between payments is known as accrued. Try different values with the calculator above.

Accrued interest is part of the cost borrowing money. If this happens its. To use the calculator you will input these numbers into each section select CALCULATE and it will show your estimated monthly payment as well as the total interest paid over the life of the loan.

Its annual percentage rate of interest probably is. The comparison rate for the ING Personal Loan is based on an unsecured loan of 30000 over a loan term of 5 years. This is not on your bank statement.

The overdraft interest rate is mainly calculated by the average daily balance method. Going into debt through the use of credit may make more sense for a larger purchase. Different amounts and terms will result in different comparison rates.

Note here that in case you make a deposit in a bank eg put money in your saving account from a financial perspective it means that you. With the money factor of 005 which translates to a 12 percent interest rate. You may notice that if you stretch the loan term out over a longer period for example from 20 years to 30 years it might mean you can borrow more however it will increase the total amount.

Overdraft Interest Calculation. The lower the interest rate the more you can borrow and the lower any minimum repayment amounts will be. The comparison tables below display some of the variable rate home loan products on Canstars database with links to lenders websites for borrowers in NSW making principal and interest repayments.

Cost of Borrowing. Mortgage rates - Mortgage calculator - Break fee calculator - non-rate incentives Reverse mortgage FAQ. What is Accrued Interest.

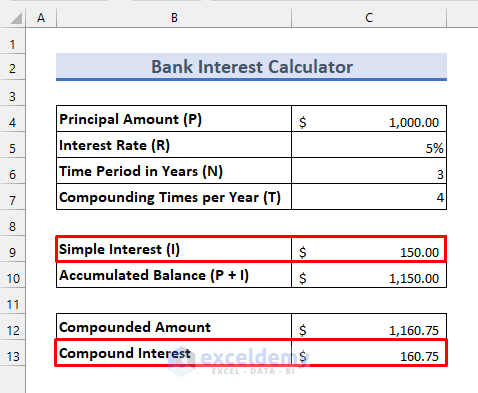

CD Calculator Compound Interest Calculator Savings Calculator Budget Calculator. For the first year we calculate interest as usual. Compare home loans on Canstars database.

This comparison rate applies only to the example or examples given. Free interest calculator to find the interest final balance and accumulation schedule using either a fixed starting principal andor periodic contributions. Demand for and supply of money government borrowing inflation Central Banks monetary policy objectives affect the interest rates.

It is calculated on the basis of the withdrawn amount. Full-function mortgage calculator LVR borrowing capacity Property upsizedownsize. Fortunately this Credit Card Interest Calculator makes the math easy.

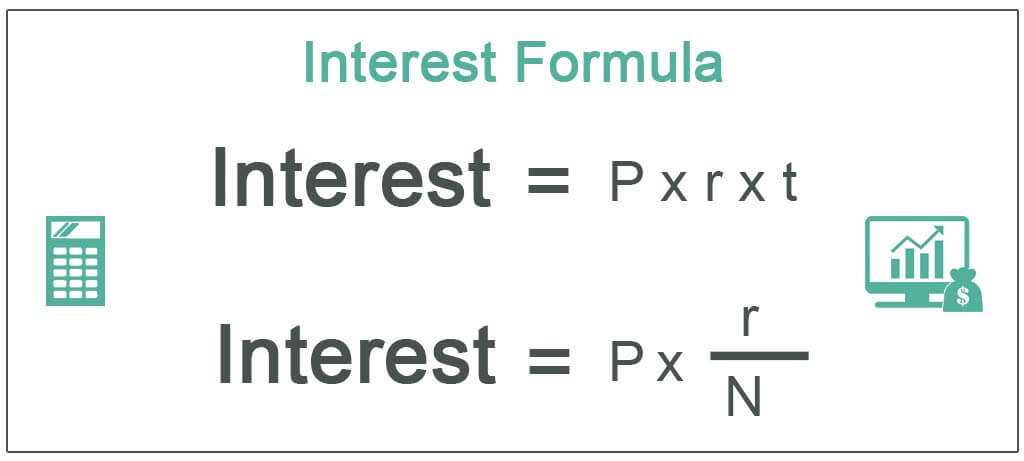

Simply input the variables click the Calculate Credit Card Interest button and youll learn not only the total amount of interest youll pay. Every year that 5 percent has to be paid back or the interest will be added to the loan and capitalized. The interest expense also known as the cost of borrowing money can be classified into the following two types.

This type of interest is calculated on the original or principal amount of loan. You can find the total actual rate your bank charges you on your latest bank statement. This fee has various names.

Just enter your current interest rate mortgage term and outstanding loan and well do the rest. 1 lakh in hisher bank account and withdraws Rs. No one will make you pay the interest on your loan either and that could become an even bigger problem.

The third part is a monthly fee that most banks charge for the overall overdraft facility. For example if the simple interest rate is 5 on a loan of. Ignoring interest can collapse the policy.

In finance interest rate is defined as the amount that is charged by a lender to a borrower for the use of assetsThus we can say that for the borrower the interest rate is the cost of debt and for the lender it is the rate of return. Savings accounts Bonus savings accounts Term deposits 1 yr Term deposits 1 - 5 years Term PIEs Deposit calculator Interest codes Credit ratings. Moneycontrol News April 26 2019 0306 PM IST.

So lets go back to the example of Derek borrowing 100 from the bank for two years at a 10 interest rate. This should be a fixed interest rate. Use this calculator to see how different savings rates can impact your savings strategy.

Say you borrow 10000 from your contract at 5 percent interest Whitman says.

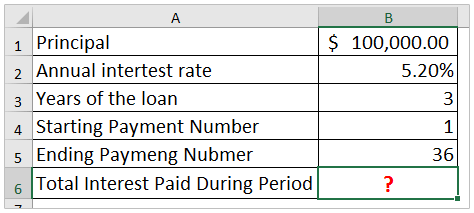

How To Calculate Total Interest Paid On A Loan In Excel

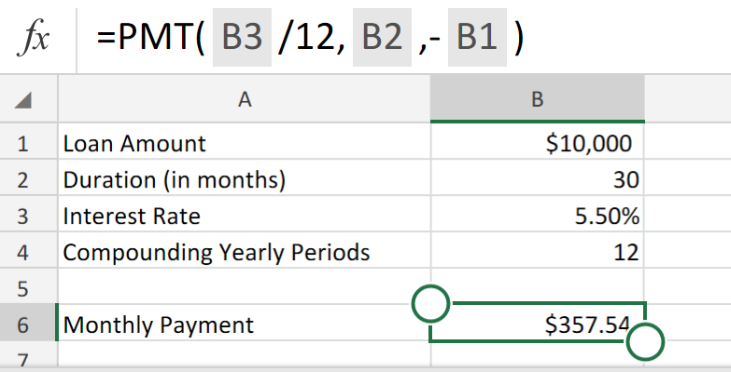

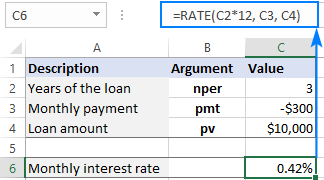

Excel Formula Calculate Interest Rate For Loan

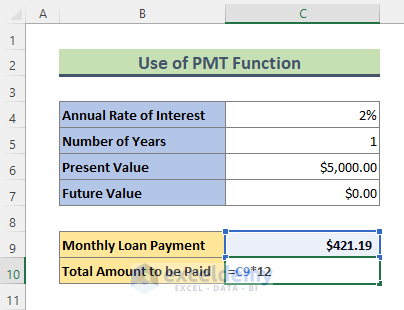

Excel Formula Calculate Payment For A Loan Exceljet

Interest On Loan Meaning Formula How To Calculate

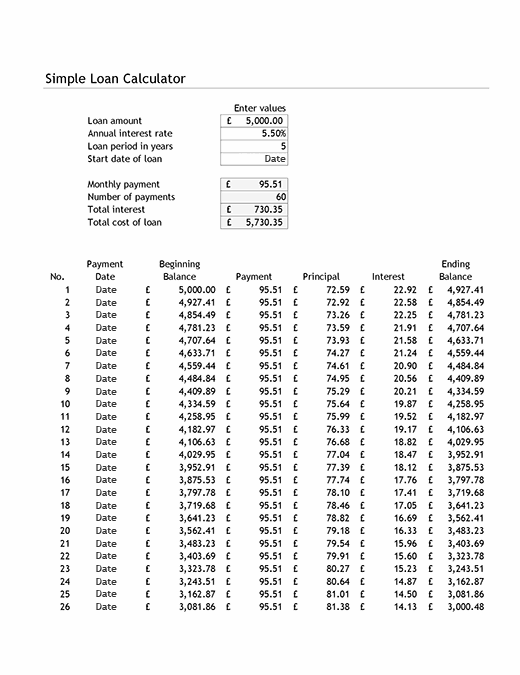

Advanced Loan Calculator

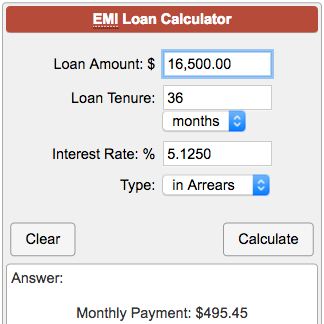

Emi Loan Calculator

How To Calculate Loan Payments Using The Pmt Function In Excel Youtube

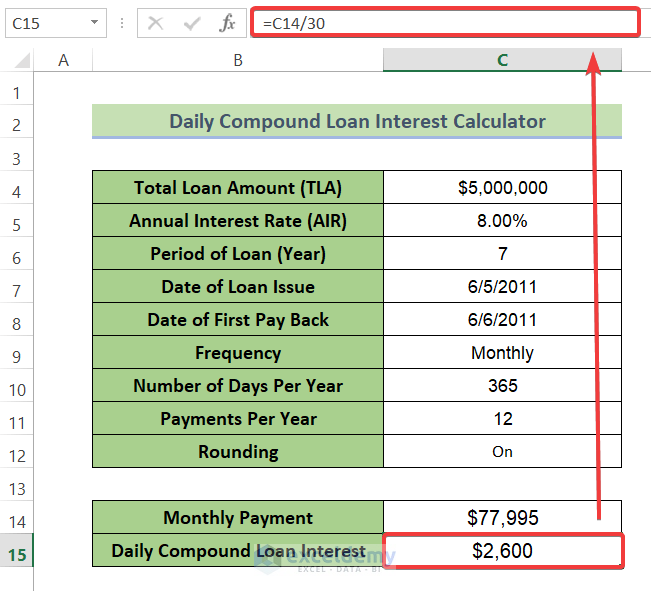

Daily Loan Interest Calculator In Excel Download For Free Exceldemy

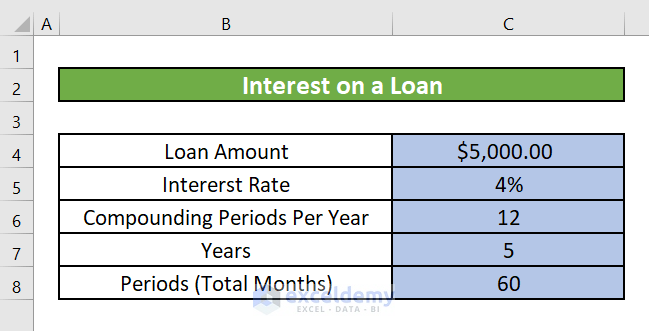

How To Calculate Interest On A Loan In Excel 5 Methods Exceldemy

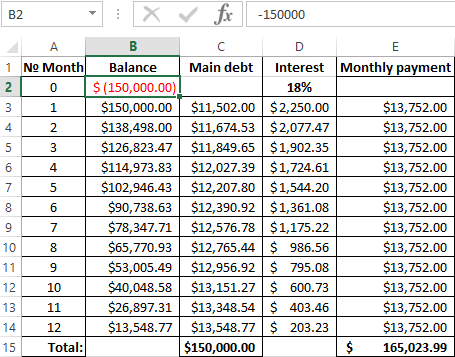

Calculation Of The Effective Interest Rate On Loan In Excel

How To Calculate Gold Loan Interest In Excel 2 Ways Exceldemy

Using Rate Function In Excel To Calculate Interest Rate

Simple Loan Calculator And Amortisation Table

Simple Interest Loan Calculator How It Works

Excel Formula Calculate Loan Interest In Given Year Exceljet

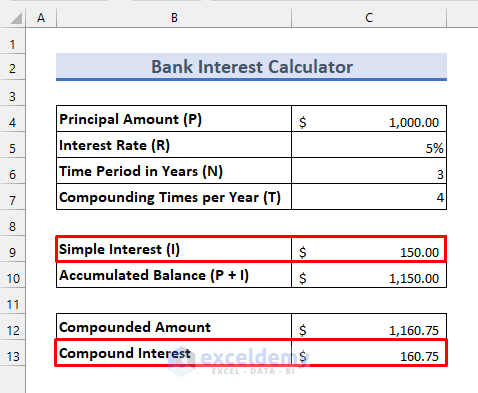

Bank Interest Calculator In Excel Sheet Download Free Template

Excel Formula Calculate Interest Rate For Loan Exceljet